New research counters risky image of popular financial investments

(�鶹��ԺOrg.com) -- They have been called "financial weapons of mass destruction" and blamed for a number of catastrophic losses and bankruptcies. New research by a finance professor at Virginia Tech's Pamplin College of Business, however, counters the popular perception of derivatives as dangerous tools and investments.

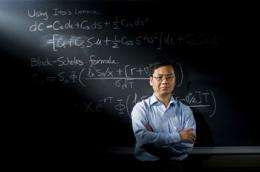

In a study to be published in the Journal of Financial and Quantitative Analysis, Yong Chen, an assistant professor of finance, investigates how derivatives are used by hedge funds and focuses on the relationship between derivatives use and hedge funds’ risk-taking behavior.

Despite the widespread use of derivatives by hedge funds, Chen says, little is known about their effects on fund risks and performance. How do derivatives users differ from nonusers with respect to fund risks and performance? Do hedge funds that use derivatives demonstrate a greater propensity for risk shifting? Are derivatives-using funds more likely to fail? “Such questions, and their answers, are very important to investors, lenders, and regulators.”

Examining more than 5,000 hedge funds during 1994-2006, Chen found that 70 percent of them trade derivatives. On average, those that do so showed lower fund risks (as measured by fund return volatility, average market exposure, and market exposure during market downturns or extreme market events). “Overall, the evidence does not suggest that derivatives use by hedge funds leads to more risk-taking.”

His findings would be of broad interest, he says, given the current concern about the risk-taking activities of hedge funds and other quasi-bank institutions among lenders, investors, and regulators, who are seeking to increase government oversight of hedge funds.

“In the past two decades,” Chen says, “derivative markets and the hedge fund industry and have experienced explosive growth and wielded increasing influence on the market and economy.”

Deriving their value from other assets, derivatives are financial instruments that allow investors to speculate on the future price of an asset — commodities or shares, for example — without buying the underlying asset. Developed to allow investors to hedge, or insure against, risks in financial markets, derivatives such as futures, options, and swaps, have become investments in their own right.

Hedge funds, which use aggressive strategies to maximize returns in managing investments of wealthy private investors or institutions, have become major players in derivative markets, Chen says. “The pervasive use of derivatives by hedge funds stands in sharp contrast to mutual funds,” he notes, citing one study that found that only about 20 percent of mutual funds use derivatives.

The high-risk image of derivatives, Chen notes, resulted from a number of spectacular financial failures, all of which involved derivatives trading: the bankruptcy of Orange County, Calif., in 1994; the collapse of British-owned Barings Bank in 1995; the fall of U.S. hedge fund Long-Term Capital Management in 1998; the failure of another U.S. hedge fund, Amaranth, in 2006; and the huge losses of French bank Société Générale in 2008. It was legendary investor Warren Buffet who called derivatives “financial weapons of mass destruction.”

Depending on the purpose — hedging or speculation — the use of derivatives may be associated with lower or higher fund risk, Chen said. “Although it cannot be ruled out that some hedge funds use derivatives to speculate on asset prices,” he says, “the overall evidence is more consistent with risk-management-motivated use of derivatives.”

Chen’s study found that “derivatives users engage less in risk shifting,” the practice in which funds performing poorly in the first half of a given year tend to increase portfolio risk in hopes of catching up in the second half, while funds performing well try to lock in their returns by lowering risk. Derivatives users, he adds, are also less likely to liquidate during market downturns.

Provided by Virginia Polytechnic Institute and State University