It's high time someone studied marijuana taxes—so we did

Consumers don't seem to mind on things like food and clothing. Marijuana may be a different story.

As marijuana taxes are imposed , many to avoid them or even in anticipation of them. If state governments don't adjust to such behavior, it will reduce revenue and most likely increase overall marijuana consumption.

Not many states have studied the implications of pot taxes on consumer behavior. .

I'm a , and data in Oregon.

We wanted to see what the economic consequences of marijuana taxes are on this . Also, we wanted to help local governments to understand them—at a time when states are increasingly relying on these new sources of revenue to .

Changing consumer behavior

Although marijuana is considered a Schedule I controlled substance by the U.S. government, meaning and is illegal to possess, have legalized the possession or sale of recreational marijuana.

As of 2019, marijuana or decriminalized marijuana possession, and support legalization.

Each state with a legalized market has . Starting on Jan. 4, 2016, Oregon officials levied on recreational marijuana, which generated that year alone.

that taxes—particularly , such as gambling, alcoholic beverages or sugary soft drinks—alter consumer behavior.

If consumers foresee tax changes, they may purchase and store large quantities before implementation of a tax. overall revenue raised by the product temporarily until consumers use their stores.

Cross-border purchasing is likely to be a more permanent issue regarding marijuana taxation, especially in states like Oregon, where of marijuana sales—making it easy to avoid taxes with a quick road trip.

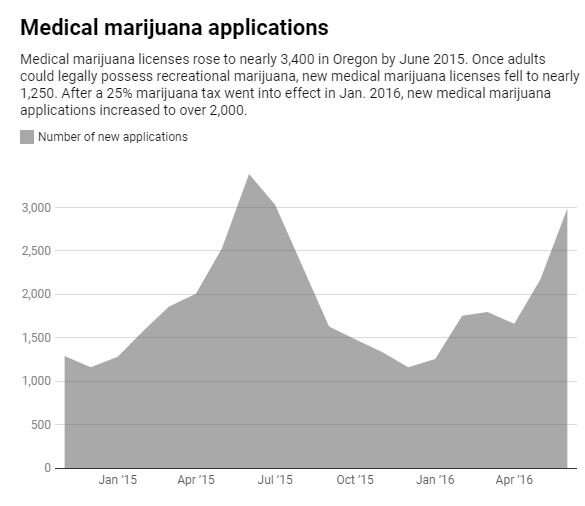

Many people shifted to immediately as you can see by the . Medical marijuana patients may also buy untaxed marijuana for friends and family, further cutting into the revenue raised.

What comes next

So what can public officials do?

One solution is to coordinate tax rates across states to avoid cross-border purchasing.

Our study also suggests that health officials need to work around medical marijuana users who circumvent taxes faced by recreational users. Connecting dispensaries electronically and making the purchasing cards computer-readable to keep track of marijuana sales could help cut down on this practice.

Provided by The Conversation

This article is republished from under a Creative Commons license. Read the .![]()