Exploring links between financial knowledge, age and gender in Japan

Analysis of results from a survey conducted in Japan reveals how financial literacy and financial behaviors are associated with age and gender, suggesting potential targets for policies to improve financial health. Shohei Okamoto of the Tokyo Metropolitan Institute of Gerontology and Kohei Komamura of Keio University in Tokyo, Japan, present these findings in the open-access journal PLOS ONE on November 17, 2021.

In industrialized countries like Japan, individuals face the challenge of building independent wealth to support themselves as they age. Public policy could help improve people's financial literacy in order to enhance their saving and asset-building abilities. However, to inform such policies, a better understanding of how financial literacy varies between individuals is needed.

To improve understanding of financial literacy in Japan, Okamoto and Komamura assessed data from an online survey of 25,000 Japanese people aged 18 to 79. Participants answered several sets of questions to measure their financial literacy, their self-rated financial knowledge, and their financial behaviors. The researchers conducted a statistical analysis of the responses to explore links between financial literacy, age and gender.

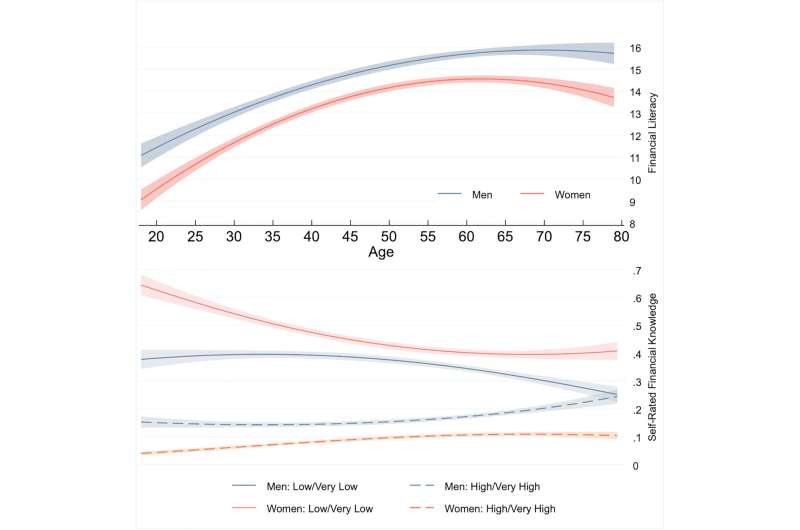

The analysis found that, in general, survey participants' financial literacy increased with age before declining in their early 60s. Meanwhile, people's confidence in their financial knowledge decreased through middle age for both men and women, before increasing again among older men.

Male survey participants had a higher level of financial literacy than female participants; statistical analysis suggests that this difference can largely be explained by differences in education. However, women reported more financially sound behaviors.

These findings support the development of policies in Japan to provide older adults with assistance in financial decision making, boost financial literacy among women, and improve financial behaviors among men. Meanwhile future research will be needed to confirm the associations identified in this study, clarify their underlying causes, and examine their impact on individuals' actual financial asset management outcomes.

The authors add: "We found an inverse U-shaped relationship between age and financial literacy, while the opposite trend is true for age and self-assessed financial knowledge."

More information: Okamoto S, Komamura K (2021) Age, gender, and financial literacy in Japan. PLoS ONE 16(11): e0259393.

Journal information: PLoS ONE

Provided by Public Library of Science